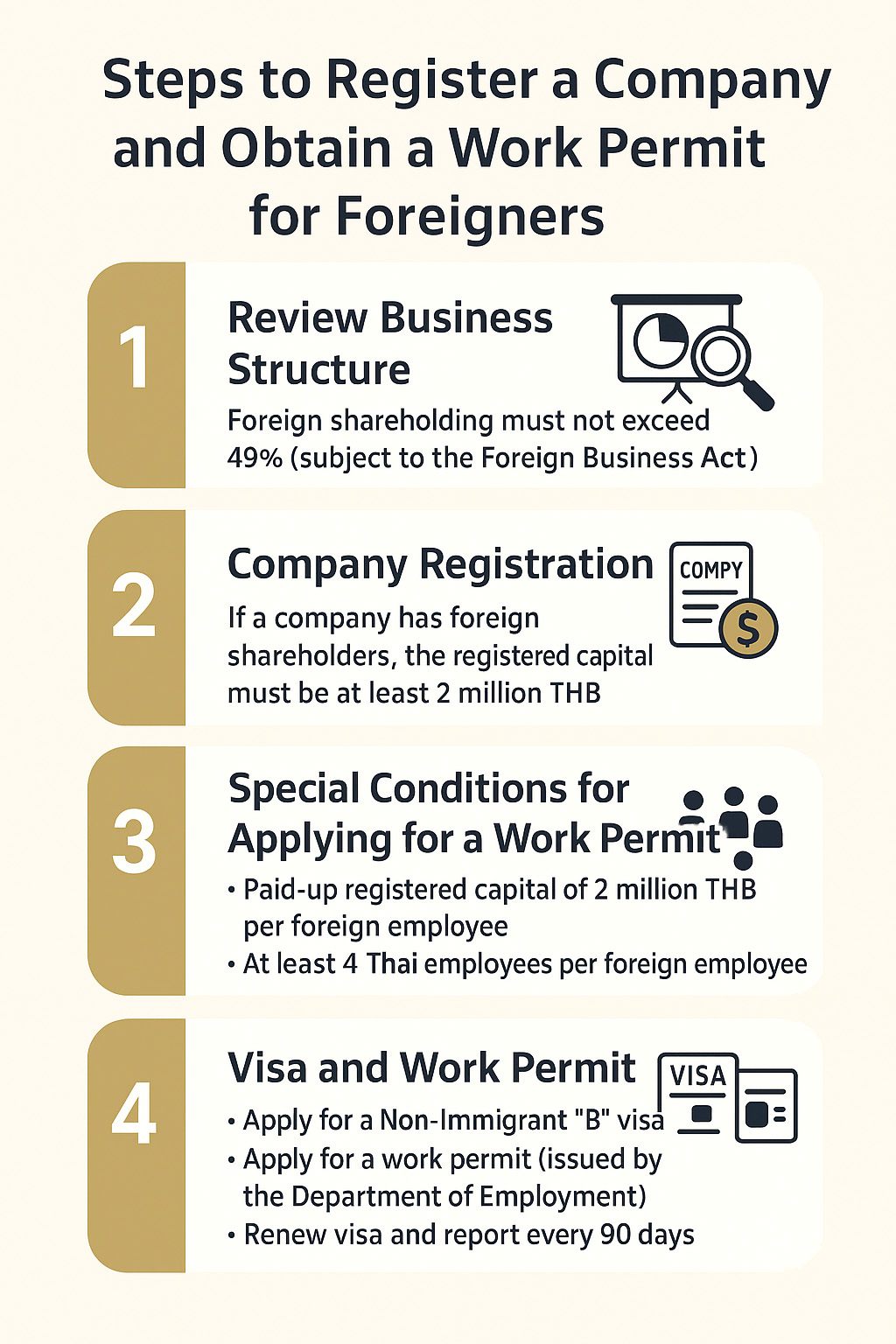

If foreigners hold more than 49% of shares, the Foreign Business Act B.E. 2542 (1999) must be considered to determine whether a Foreign Business License (FBL) is required.

If foreigners hold no more than 49% and Thai shareholders hold at least 51%, the company can be registered as a limited company under the Civil and Commercial Code.

Proceed at the Department of Business Development (DBD).

Minimum registered capital of 2 million THB is required (if there is a foreign shareholder and one Work Permit application).

If applying for multiple Work Permits, the registered capital must be increased proportionally.

The company must have at least 2 million THB of paid-up capital for each foreign employee.

There must be at least 4 Thai employees per 1 foreigner (except for BOI or Smart Visa, which may be exempted).

The company must register for VAT if annual revenue exceeds 1.8 million THB.

Department of Business Development (DBD): Company registration

Department of Employment: Work Permit application

Immigration Bureau: Visa application and renewal

Board of Investment (BOI): Benefits and certain exemptions

Revenue Department: Income tax, VAT

1. Non-Immigrant "B" Visa (Business Visa)

Apply at a Thai embassy abroad or request a visa change in Thailand (at the Immigration Bureau).

2. Work Permit Application

Submit to the Department of Employment, Ministry of Labor.

Required documents include: Company affidavit, business registration, shareholder list, financial statements, photos, etc.

3. Visa and Work Permit Renewal

Renew annually (1-year cycle).

Report to Immigration every 90 days.

1. Businesses allowed without restriction (not prohibited under the Foreign Business Act B.E. 2542)

Export business

Manufacturing for export (not for domestic sale)

Certain technology or engineering businesses in which Thailand lacks expertise

Service businesses not listed as restricted (e.g., specialized consulting)

BOI-promoted businesses such as:

Information technology (IT, Software, AI)

Renewable energy, Environment

Research and development, Biotechnology

International logistics

Medical and healthcare

If foreign ownership exceeds 49%, a Foreign Business License (FBL) from the Ministry of Commerce is required.

Examples include:

Retail and wholesale trade

Real estate development and property management

General service businesses such as consulting and management

Tourism business (if as an operator, not as a tour guide)

(According to the annex of the Ministry of Labor and the FBA)

Small-scale retail, selling at local markets

Tour guide services

Beauty services such as hairdressing, nail salons

Traditional handicrafts and Thai artisan work

Basic agriculture such as farming, rice cultivation, gardening

| Business Category | Restriction Level | Examples | Conditions/Exemptions |

|---|---|---|---|

| List 1 – Completely Prohibited | ❌ 100% Prohibited | Publishing, Broadcasting, Agriculture, Rice, Forestry, Thai Herbs, Ancient Art, Land Trading | No exemptions |

| List 2 – Restricted, Cabinet Approval Required | ⚠️ Allowed with Cabinet approval + Thai ownership ≥ 40% | Domestic transportation (land/water/air), Mining, Weapon production, Antique trading | Must apply via DBD and receive Cabinet approval |

| List 3 – Restricted, FBL Required | ⚠️ Allowed with FBL from DBD | General construction, Retail/Wholesale, Restaurants, Hotels, Legal/Accounting/Advertising services | Assessed based on benefits to Thai economy (employment, technology transfer) |

| BOI Promotion | ✅ Many restrictions exempted | Logistics, Warehousing, Technology, Targeted industries | Foreigners may own 100%, tax incentives, no FBL required in some cases |

| Treaty | ✅ Exemptions under agreements | US–Thai Treaty of Amity, JTEPA (Japan–Thailand), ACIA (ASEAN) | Rights similar to Thai nationals, must confirm with DBD |

| Ministerial Regulation | ✅ No FBL required | Representative Office, Regional Office, Intra-group consulting, Lending or leasing office space within group | Report to DBD but FBL not required |